FedEx reports earnings today, and the story goes way beyond shipping packages. This company spent two years cutting costs, restructuring operations, and promising investors that efficiency gains would protect profits when business slowed down. Today we find out if any of that actually worked.

The broader market is up, but individual companies are getting hammered for execution failures. Super Micro just announced they need to raise $2 billion in debt, sending the stock down 10%. That tells you everything about how fast investor patience disappears when management makes questionable decisions.

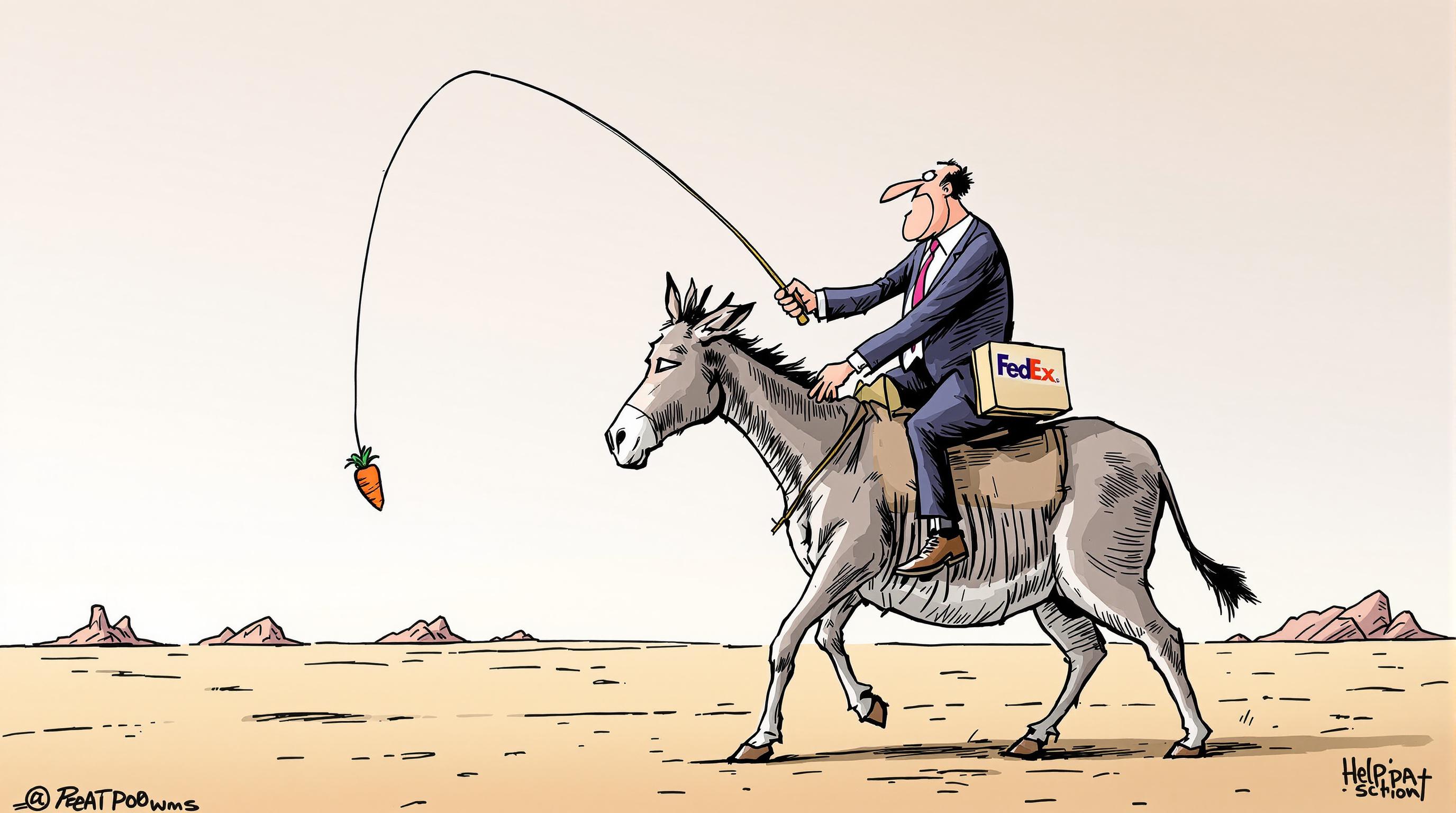

Here’s what separates winning investments from value traps: companies that execute when conditions get tough versus those that make excuses.

FedEx: Two Years of Promises Meet Reality

FedEx has been selling investors on operational transformation for two years. They lost the massive U.S. Postal Service contract. Global shipping demand has been weak. Tariffs are creating additional headwinds. Management’s answer has been cost cuts, facility consolidations, and efficiency programs.

The DRIVE program generated $600 million in savings last quarter alone, bringing year-to-date savings to $1.4 billion. Management is targeting $2.2 billion in annual savings for fiscal 2025, with a longer-term goal of $4 billion compared to fiscal 2023 baseline. They’ve closed facilities, laid off workers, and streamlined operations. The question investors need answered today: did these moves actually improve the business, or just mask declining fundamentals?

Wall Street expects earnings of $5.88 per share on revenue around $21.8 billion. Last quarter, FedEx reported $4.51 EPS, slightly below the expected $4.61, though revenue of $22.2 billion beat forecasts. The company already lowered full-year EPS guidance to $18.00-$18.60 from the previous $19.50-$20.50, reflecting ongoing freight segment challenges.

The freight business spin-off remains a wildcard. Management has been evaluating options for FedEx Freight, and many analysts believe separating it could unlock significant shareholder value. Any concrete timeline or structure details today would be a major catalyst.

Super Micro: When Growth Companies Need Emergency Funding

Super Micro’s $2 billion debt announcement Monday sent the stock down 9.8%, making it the worst-performing stock in the S&P 500 that day. The company has benefited enormously from AI infrastructure demand, but also faces the cash requirements that come with rapid expansion to meet AI server demand.

The company already lowered its fiscal 2025 revenue forecast to $21.8-$22.6 billion from the previous $23.5-$25 billion in May. Management claims the debt raise supports expansion to meet AI server demand, but that’s exactly what companies say when growth requires more cash than operations generate.

The AI boom has created massive opportunities for companies like Super Micro, but it’s also created massive cash requirements. Building server infrastructure requires significant working capital, and customer payment cycles can strain even profitable companies.

Investors need to ask whether this debt raise represents smart capital allocation for growth opportunities, or whether it reveals cash flow problems that aren’t showing up in earnings reports yet.

Carnival: How Real Recovery Actually Works

Carnival provides the perfect contrast to both FedEx and Super Micro. The cruise line delivered record revenues of $25 billion last year, up over 15% from 2023. More importantly, they generated $1.9 billion in net income while paying down massive debt burdens.

The company has reduced debt by over $8 billion from its January 2023 peak, ending 2024 with $27.5 billion in debt. Interest expense will be $200 million lower this year than last year. Carnival projects adjusted net income of approximately $2.3 billion for 2025, with cumulative advanced bookings at all-time highs for both pricing and occupancy.

Carnival’s execution validates their recovery thesis with measurable financial improvements. Debt reduction creates operational flexibility. Strong bookings provide revenue visibility. Margin expansion proves pricing power.

What This Means for Your Portfolio

These three companies represent different stages of the execution cycle. Carnival shows how proper management navigates through crisis to emerge stronger. FedEx tests whether cost-cutting strategies can maintain profitability during slow growth periods. Super Micro reveals how fast growth opportunities can create cash flow pressures.

For investors, the lesson is clear: focus on companies demonstrating operational improvement through measurable financial metrics. Revenue growth, margin expansion, debt reduction, and cash flow generation matter more than management promises or market hype.

FedEx’s results today will show whether their transformation efforts have substance or just window dressing. Super Micro’s debt raise questions whether AI growth stories can sustain their cash requirements. Carnival’s continued debt reduction proves some companies actually execute successfully.

The Real Execution Test

Smart investors watch how companies perform when conditions get challenging. Easy money and growing markets hide operational weaknesses. Economic uncertainty and competitive pressure expose them.

Companies that maintain margins, generate cash flow, and strengthen balance sheets during difficult periods typically reward shareholders over time. Those that require constant capital raises, miss guidance, or blame external factors for poor performance usually disappoint.

FedEx reports in about eight hours. The numbers will reveal whether two years of restructuring created a more efficient business or just delayed inevitable margin compression.

Watch the earnings per share growth. Watch the cash flow generation. Watch the forward guidance confidence.

Because execution always shows up in the financial statements, regardless of what management presentations promise.

Richard Hale is a contributor to Wealth Creation Investing, where he delivers high-intensity market breakdowns focused on stock momentum, earnings strength, and strategic catalysts. His commentary cuts through noise, tracks capital in motion, and highlights where fundamentals and opportunity collide with zero patience for excuses, spin, or slow-footed analysis.